What is morning star pattern:

Morning Star Pattern ek technical analysis ka tijarat tanazur hai jo market trends ko samajhne aur future price movements ko predict karne ke liye istemal hota hai. Yeh ek bullish reversal pattern hai, jise traders market mein bearish phase ke baad uptrend ke shuru hone ka sign samajhte hain.

Morning Star Pattern Kya Hai?

Morning Star Pattern ek candlestick pattern hai, jo typically teen consecutive candles se milta hai. Yeh pattern bearish trend ke baad aata hai aur ek potential trend reversal ko represent karta hai.

Morning Star Pattern ek technical analysis ka tijarat tanazur hai jo market trends ko samajhne aur future price movements ko predict karne ke liye istemal hota hai. Yeh ek bullish reversal pattern hai, jise traders market mein bearish phase ke baad uptrend ke shuru hone ka sign samajhte hain.

Morning Star Pattern Kya Hai?

Morning Star Pattern ek candlestick pattern hai, jo typically teen consecutive candles se milta hai. Yeh pattern bearish trend ke baad aata hai aur ek potential trend reversal ko represent karta hai.

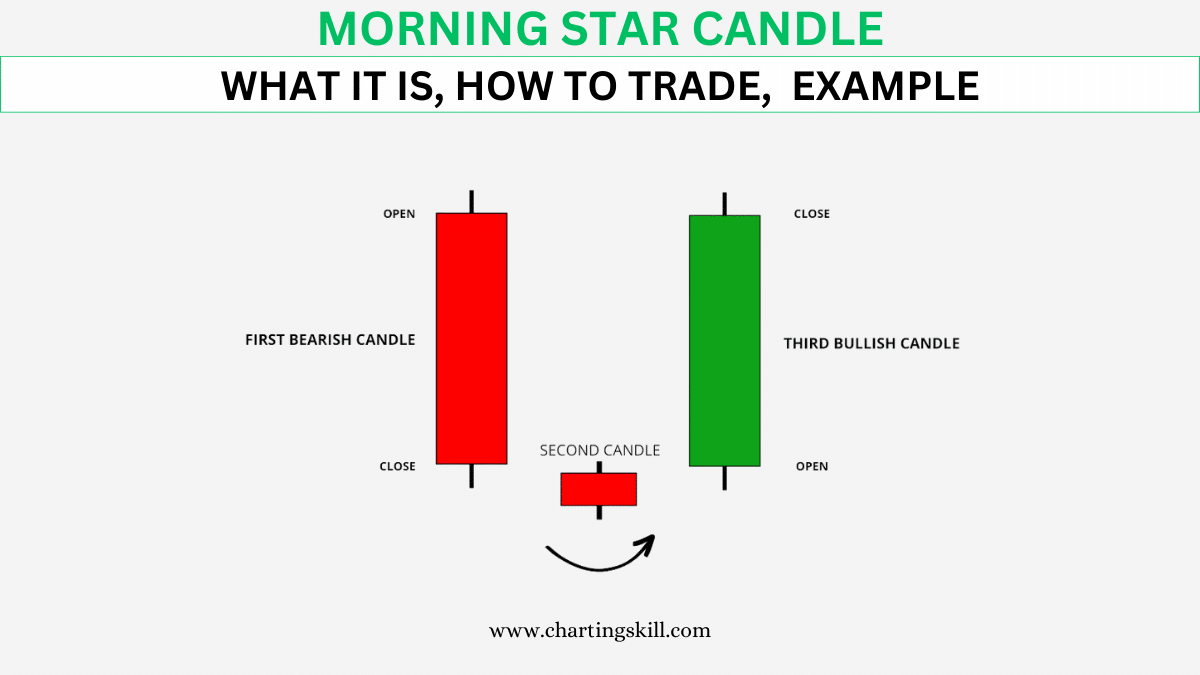

- Pehla Candle (Bearish): Morning Star Pattern ki shuruaat hoti hai ek lambi bearish candle ke saath. Yeh candle existing downtrend ko reflect karta hai aur sellers ki dominance ko darust karta hai.

- Doosra Candle (Indecision): Doosre candle mein market mein indecision hoti hai, yani buyers aur sellers ke darmiyan ek mawafiq mukhlis baat cheet. Is candle ki body choti hoti hai aur shadows lambi hote hain.

- Teesi Candle (Bullish): Tisri aur aakhri candle ek lambi bullish candle hoti hai, jo indicate karta hai ke buyers ne control haasil kiya hai aur uptrend shuru ho sakta hai. Is candle ke closing price pehle do candles ke beech ke range ke bahar hoti hai.

Morning Star Pattern Ka Istemal:

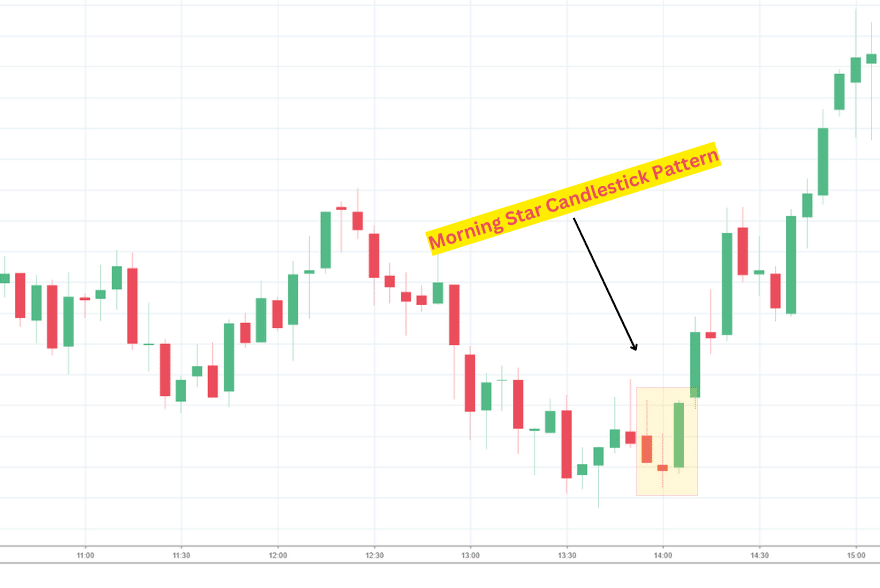

Morning Star Pattern ka istemal market mein trend reversal ko predict karne ke liye hota hai. Jab ye pattern dikhai deta hai, to traders ko signal milta hai ke bearish trend khatam ho sakta hai aur bullish trend shuru hone wala hai.

Traders is pattern ko confirm karne ke liye doosre technical indicators aur tools ka bhi istemal karte hain jaise ke volume analysis, moving averages, aur RSI (Relative Strength Index).

Faida aur Hifazati Tadbirat:

Morning Star Pattern ka istemal kar ke traders apne trading strategies ko refine kar sakte hain aur market trends ko sahi taur par samajh sakte hain. Lekin, hamesha yaad rahe ke kisi bhi tijarat tanazur par amal karne se pehle thorough research aur risk analysis zaruri hai. Market mein risk hamesha hota hai, aur isliye hifazati tadbirat ko mad-e-nazar rakha jana chahiye.

Is pattern ka istemal karne se pehle, traders ko market conditions aur doosre factors ka bhi khayal rakhna chahiye taake woh sahi trading decisions le sakein.

تبصرہ

Расширенный режим Обычный режим